2025 Deferred Comp Contribution Limits

2025 Deferred Comp Contribution Limits. Cost of living adjustments may allow for additional. The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts).

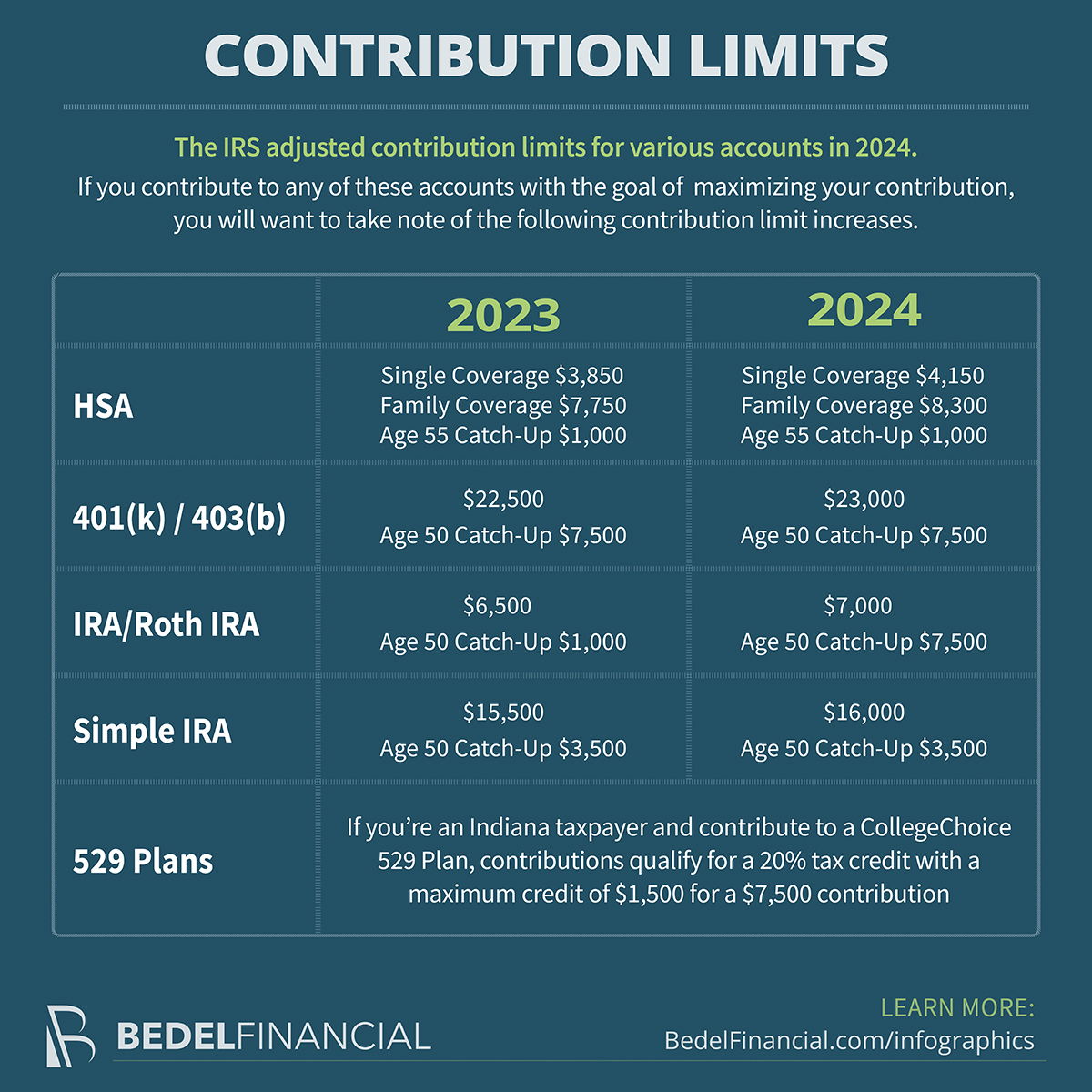

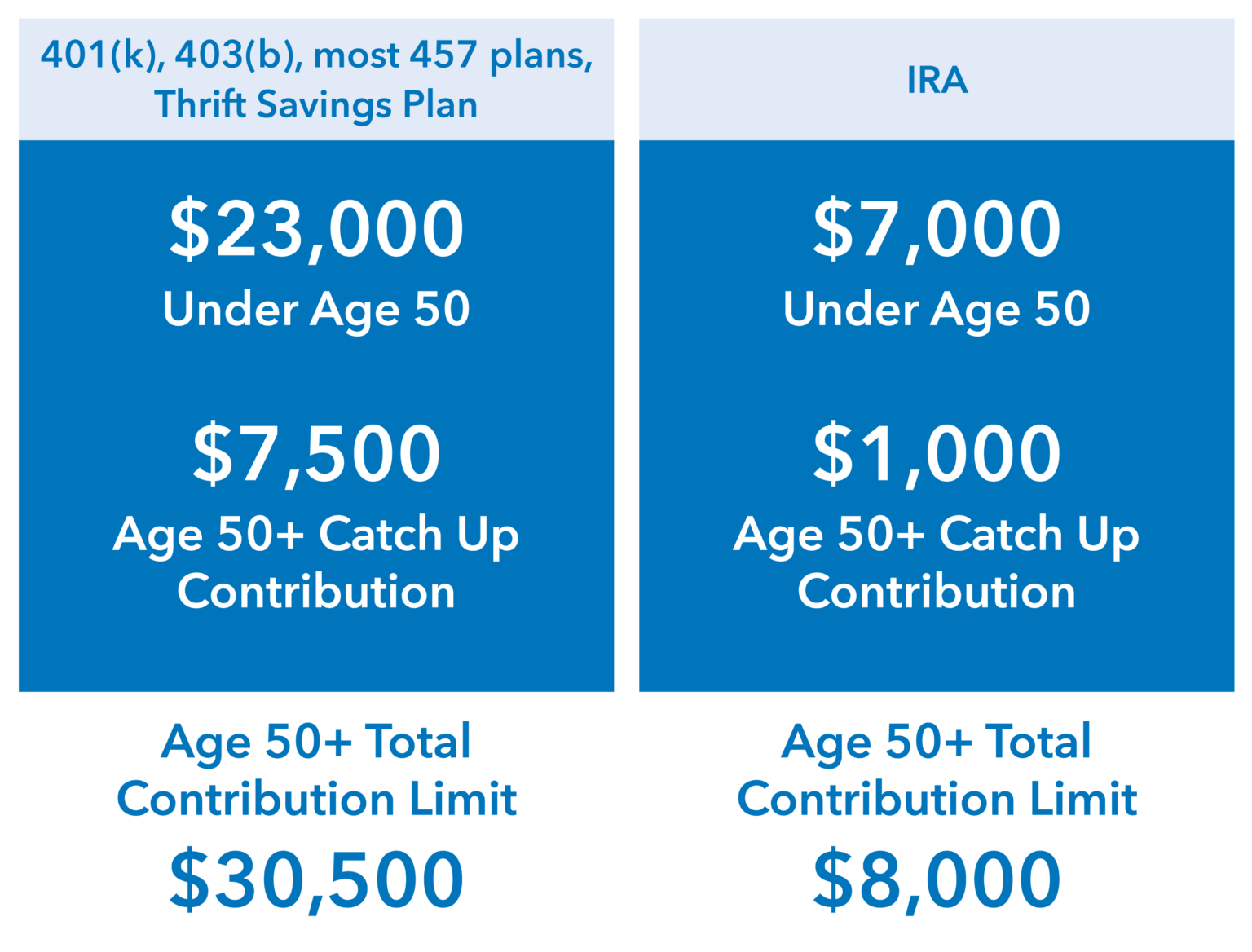

Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older). The maximum allowable annual contribution to a 401(k) account for 2023 is $22,500, increasing to $23,000 for tax year 2025.

The 2025 401(K) Individual Contribution Limit Is $23,000, Up From $22,500 In 2023.

Here's a detailed look at the 2025 retirement contribution limits and what they mean for your financial planning.

The Limit On Deferrals Under Section 457(E)(15), Which Pertains To Deferred Compensation Plans Of State And Local.

Adjusted deferred compensation limit 403b.

2025 Deferred Comp Contribution Limits Images References :

Source: aleneqjenifer.pages.dev

Source: aleneqjenifer.pages.dev

Irs Tax Deferred Contribution Limits 2025 Thea Abigale, The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. What is the 401(k) contribution limit in 2025?

Source: jonathanhutchinson.z21.web.core.windows.net

Source: jonathanhutchinson.z21.web.core.windows.net

401k 2025 Contribution Limit Chart, Adjusted deferred compensation limit 403b. The maximum annual contribution limit for 457 (b) plans is $23,000 for 2025 (or 100% of gross annual compensation, if less).

Source: www.bedelfinancial.com

Source: www.bedelfinancial.com

2025 Contribution Limits, Adjusted deferred compensation limit 403b. The irs has increased your overall contribution limit for.

Source: elianorawariana.pages.dev

Source: elianorawariana.pages.dev

401k Contribution Limits 2025 For Highly Compensated Employees Toma, Keep in mind that as an employee’s deferrals increase, the section 415(c) limits may come into play, depending. What is the 401(k) contribution limit in 2025?

Source: jocelinwdawn.pages.dev

Source: jocelinwdawn.pages.dev

2025 Simple Ira Contribution Limits 2025 Single Deeyn Evelina, Keep in mind that as an employee’s deferrals increase, the section 415(c) limits may come into play, depending. Currently, the deduction in respect of contribution towards the pension scheme notified by the central government (nps and atal pension yojana) as per section 80ccd(1b) of.

Source: ileaneqgerhardine.pages.dev

Source: ileaneqgerhardine.pages.dev

Irs Solo 401k Contribution Limits 2025 Gerty Juliann, Here's a detailed look at the 2025 retirement contribution limits and what they mean for your financial planning. That’s an increase of $500 over 2023.

Source: gwynethwcasi.pages.dev

Source: gwynethwcasi.pages.dev

401k 2025 Deferral Limits Nesta Adelaide, If you're age 50 or. The 2025 section 415(c) limit is $69,000.

Source: merkleretirementplanning.com

Source: merkleretirementplanning.com

2025 By The Numbers Merkle Retirement Planning, Increase in contribution limits for 457(b) plans: Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older).

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2025, Employees can invest more money into 401(k) plans in 2025, with contribution limits increasing from 2023’s $22,500 to $23,000 for 2025. This limit includes all elective employee salary deferrals and any contributions.

Source: quinnqcharmion.pages.dev

Source: quinnqcharmion.pages.dev

401k Contribution Limits 2025 With Employer Match Kaile Marilee, What is the 401(k) contribution limit in 2025? Adjusted deferred compensation limit 403b.

The 2025 401(K) Individual Contribution Limit Is $23,000, Up From $22,500 In 2023.

Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000.

If You're Age 50 Or.

That’s crucial info for participants in nonqualified deferred comp (nqdc) plans.

Posted in 2025