2025 Max 401 Contribution

2025 Max 401 Contribution. The irs has announced the 2025 contribution limits for. This amount is up modestly from 2023, when the individual 401.

There are actually multiple limits, including an individual. The 401(k) contribution limit is $23,000.

Max Roth 401K Contribution 2025 Over 55.

Simple 401(k) plan contributions max out at $16,000 for the 2025 tax year.

The Internal Revenue Service Said Friday That It Will Boost The Maximum Contribution Limit To Employee 401 (K) Accounts By $2,000 Next Year To $22,500, The.

The limit for employer and employee.

2025 Max 401 Contribution Images References :

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), For 2025, the employee contribution limit for 401(k) plans is $23,000, up from $22,500 in 2023. The total maximum allowable contribution to a defined contribution plan (including both employee and employer contributions) is expected to rise by $2,000.

Source: insights.wjohnsonassociates.com

Source: insights.wjohnsonassociates.com

401(k) Contribution Limits & How to Max Out the BP Employee Savings, The 401(k) contribution limit is $23,000. This amount is up modestly from 2023, when the individual 401.

Source: www.internetvibes.net

Source: www.internetvibes.net

Choosing The Best Small Business Retirement Plan For Your Business, More than this year, if one firm’s forecast is any indication. $19,500 in 2020 and 2021 and $19,000 in 2019), plus $7,500 in 2023;.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

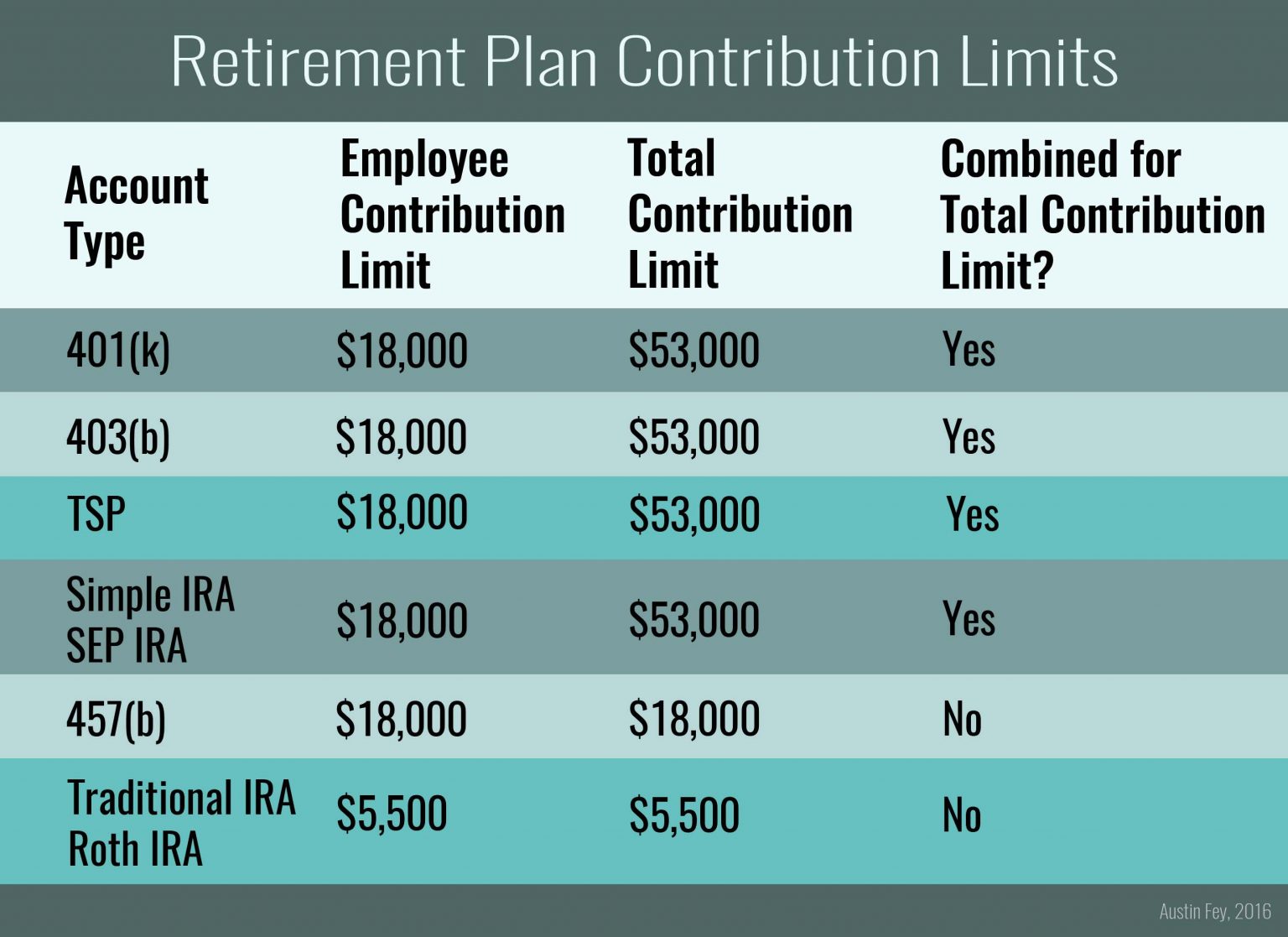

2022 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, HSA, For 2025, a 401 (k) participant filing single can contribute up to $23,000 (up from $22,500 in 2023). Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2023 and 2025.

Source: gabriellawshir.pages.dev

Source: gabriellawshir.pages.dev

Max Roth 401 K Contribution 2025 Reena Catriona, For 2025, a 401 (k) participant filing single can contribute up to $23,000 (up from $22,500 in 2023). The income levels used to determine eligibility.

Source: shandywtandi.pages.dev

Source: shandywtandi.pages.dev

401k Contribution 2025 Max Karin Marlene, The irs has announced the 2025 contribution limits for. Employees can contribute up to $23,000 to their 401 (k) plan for 2025 vs.

Source: feneliawginni.pages.dev

Source: feneliawginni.pages.dev

Roth Ira Contribution Limits Calendar Year Denys Felisha, Max roth 401k contribution 2025 over 55. Contribution limits for simple 401(k)s in 2025 is $16,000 (from.

Source: www.curoprivatewealth.com

Source: www.curoprivatewealth.com

Maximum 401(k) Contributions What to Know, Every year, the irs sets the maximum 401(k) contribution limits based on inflation (measured by cpi). The internal revenue service said friday that it will boost the maximum contribution limit to employee 401 (k) accounts by $2,000 next year to $22,500, the.

Source: darlinewalica.pages.dev

Source: darlinewalica.pages.dev

Maximum Solo 401k Contribution 2025 Jodie, There are actually multiple limits, including an individual. Contribution limits for simple 401(k)s in 2025 is $16,000 (from.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, The total maximum allowable contribution to a defined contribution plan (including both employee and employer contributions) is expected to rise by $2,000. Anyone age 50 or over is eligible for an additional.

If You Are 50 Years Old Or Older, You Can Also Contribute Up To $7,500 In.

Contribution limits for simple 401(k)s in 2025 is $16,000 (from.

401K 2025 Employer Contribution Limit Irs.

This limit includes all elective employee salary deferrals and any.

Category: 2025